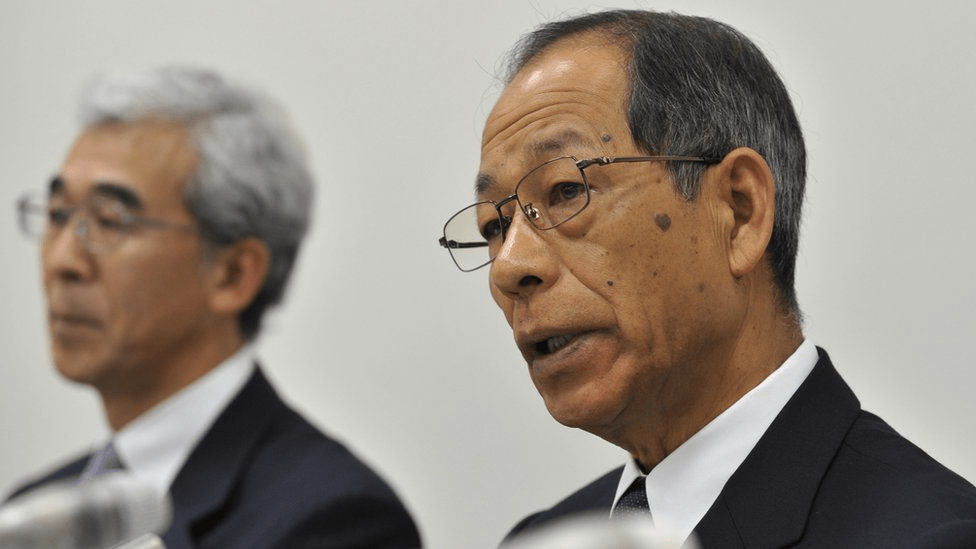

In the high-stakes world of corporate finance, few scandals have been as revealing and damaging as the Olympus accounting scandal. What was once a leading name in imaging and medical technologies became infamous for its role in one of Japan’s largest financial deceptions. The scandal broke in 2011 when it was discovered that Olympus had been concealing over $1.7 billion in investment losses through dubious accounting maneuvers and fraudulent reporting. This blog will take you through the dramatic events that led to the unmasking of Olympus’s financial misconduct, the fallout from the scandal, and the changes it prompted in corporate governance practices.

As the Olympus scandal unfolded, the depth of the company’s financial misconduct became increasingly apparent. Investigations revealed that Olympus had used a combination of complex financial instruments and obscure accounting practices to obscure the true state of its finances. The company engaged in aggressive accounting maneuvers, such as inflating the value of investments and masking losses through inflated acquisition costs. These deceptive practices were designed to create a façade of financial health, shielding the company from scrutiny and protecting its stock value.

The uncovering of these fraudulent activities did more than just damage Olympus’s reputation; it exposed significant weaknesses in the broader financial regulatory framework. The scandal highlighted how a lack of transparency and effective oversight could allow even a reputable company to engage in large-scale financial deceit. The aftermath saw a push for stricter regulatory measures and reforms in both Japan and internationally, aiming to bolster the integrity of corporate financial reporting and prevent similar scandals from occurring.

Leave a comment